Key 2024 Tax Changes:

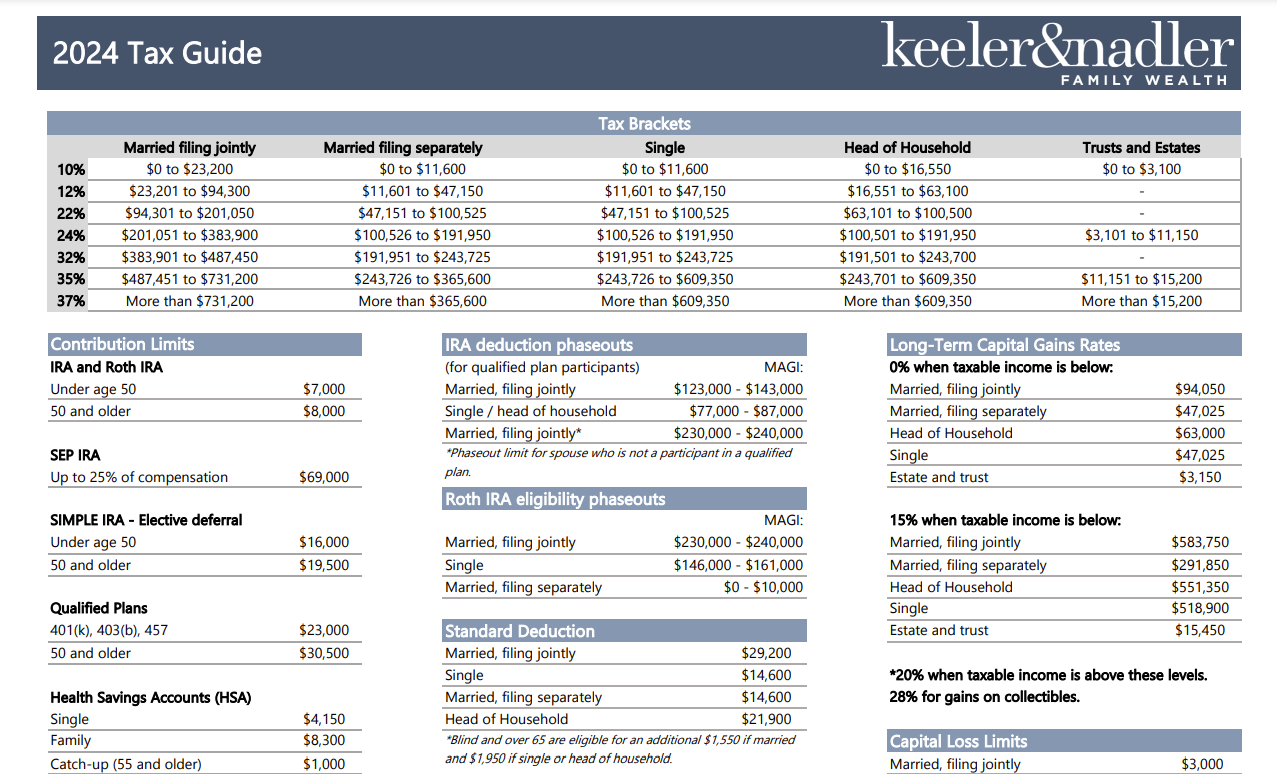

- 401(k) / 403(b) employee deferral limit has increased to $23,000

- Additional catch-up contribution for those 50 and older remains at $7,500

- IRA and Roth IRA contribution limits increased to $7,000

- Additional catch-up for those 50 and older remains at $1,000

- HSA contribution limit increased to $4,150 for individual and $8,300 for family coverage

- Additional catch-up for those 50 and older remains at $1,000

- Social Security wage base increases to $168,600

- Standard deduction increased to $14,600 for Single or Married Filing Separate, $29,200 for Joint filing and $21,900 for Head of Household

- Additional standard deduction for those over 65 years of age or blind also increased to $1,950 for Single or Head of Household filing and $1,550 (per individual) if filing Married

As we face these tax changes, the importance of informed and strategic financial planning cannot be overstated. Keeler & Nadler Family Wealth is dedicated to providing you with personalized guidance to navigate these updates effectively. We understand that each financial situation is unique, and our goal is to assist you in optimizing your financial planning to meet these new challenges head-on.

We encourage you to engage with our team for a personalized consultation to explore how these tax changes affect your specific financial landscape and to craft strategies that align with your financial goals. Together, let’s ensure that the 2024 tax changes serve as a foundation for a secure and prosperous financial future.