If you inherited an Individual Retirement Account (IRA) from someone other than your spouse within the past few years, you may be wondering what the rules are for Required Minimum Distributions (RMDs). Previously, the old rules allowed those who inherited these accounts to take an RMD based on their life expectancy. Meaning, if you inherited this account in your 50s, you could spread this income (and the tax on this income) over 30-40 years.

When the SECURE Act was passed in December 2019, the laws for non-spouse inherited IRAs were changed to a 10-year rule. Immediately, there were questions of how this 10-year rule would be implemented; is there still an annual RMD or can an individual withdrawal whenever they decide within 10 years?

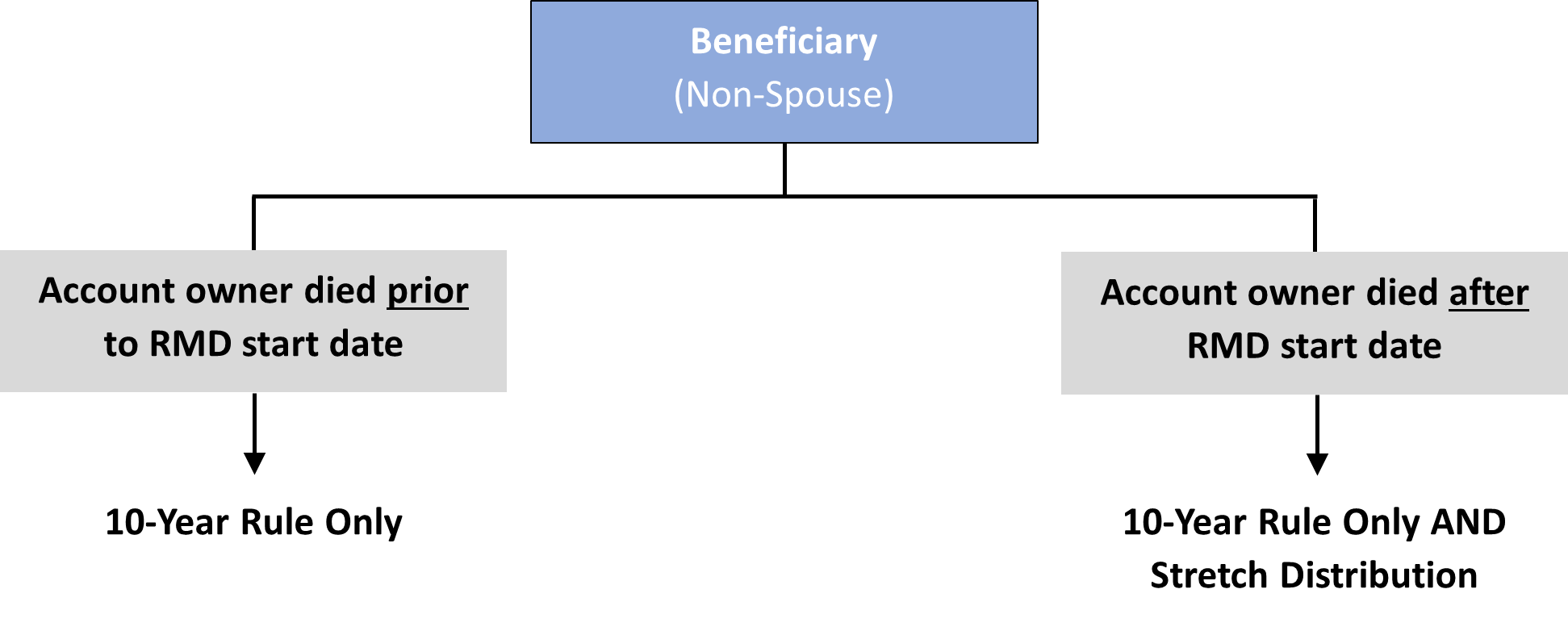

In March 2022, the IRS issued proposed regulations to try to clarify the annual RMD rules. They proposed that the annual requirement was determined by the age of the decedent; if the decedent was already RMD age (at that time 70-½ years old), the beneficiary of the inherited IRA must continue to take annual minimum IRA distributions based on the same life expectancy tables under the old RMD rules, but with the added rule of depleting the remainder of the account by year 10. The beneficiary can always take more out over those 10 years, but there would be a minimum required for years 1-9 in this scenario. In the same proposed regulations, the IRS stated if the IRA decedent was not RMD age before passing, the beneficiary of the IRA did not need to take any annual distribution from the inherited IRA and could wait to disperse the account balance in year 10 if they wish.

It’s safe to say if you inherited an IRA from a (non-spouse) decedent under RMD age, you will not be required to take an annual RMD from your inherited account; however, the account still needs to be dispersed entirely (i.e., taxes need to be paid) by year 10. For those who are in the opposite scenario where the decedent was already taking RMDs, we are still waiting for the final clarification for annual distributions as these proposed regulations have not been finalized at this time. Because of this, the IRS issued relief for beneficiaries in October 2022, stating those that did not take an annual RMD in 2021 or 2022 will not be penalized. Over the summer, the IRS extended this relief to apply to 2023 RMDs as well. Essentially, the

IRS is not making a final judgement on the annual requirement, but should the proposed regulations be passed, they will not penalize you for previous “missed” RMDs.

So where do we go from here? The IRS has said that any new regulations they put in place will go into effect for calendar year 2024, meaning we are hoping to have the final regulations by next year. In the meantime, we are making plans for each individual tax situation. If you have an inherited IRA from 2020 or after, we will be discussing tax strategies for annual distributions in anticipation of the 10-year payout.