It was hard to escape the news coverage of the frenzy over GameStop stock over the last few weeks.

Stories of overnight millionaires battling the hedge fund billionaires over a small video game retailer’s stock is something known as a “short squeeze.” Adding to the peculiar nature of the situation was the crowd of investors following the direction of a Reddit social media chat group call Wallstreetbets.

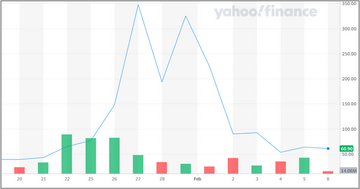

This sent the stock price up more than 1,800% in about a week. A major hedge fund that was on the wrong side of the trade lost more than 50% in the fund over that time. Eventually market custodians, including RobinHood, a favorite of new traders, had to stop transactions in GameStop. This led to a rapid decline in the stock’s price from a high of more than $400 down below $60, a drop of more than 80%.

It seems like the game is over for the GameStop frenzy, but is this and other market anomalies something we should be concerned about? The short answer is no. While these kinds of events are certainly not healthy, they are still isolated compared to the overall market.

The day GameStop’s stock rose more than 100% in a day, the S&P finished slightly down. GameStop is a very small company compared to the rest of the market.

Euphoria in the market can be a sign of an impending market bubble. Many are drawing connections to these instances of speculation to the “dot-com” bubble in 1999/2000. While it’s true that stock valuations are higher than average, there are still a lot of differences between 20 years ago and today. As corporate earnings are being released, many of them are showing numbers higher than a year ago, before the pandemic’s effects began. That is a remarkable thing. The long-term outlook for stocks still seems to be intact. Historically low interest rates and low bond yields are also pointing investors toward stocks offering support.

That said, we always want to be prepared for market pull-backs. In any given year, the S&P 500 sees a decline of about 14% (Source: JPMorgan Guide to the Markets). So, we should be prepared to see a correction or two this year. But those should be more of a buying opportunity for long-term investors.

It can be exciting to see huge return stories like GameStop; unfortunately many invested at the top and—at least for now—are seeing losses rather than taking gains.

We need to remember to take our emotions out of our portfolios and remain diligent and focused on the long term.