After finishing the first three quarters up over 10%, the S&P 500 reversed course this month and is in the red for the year (source: Morningstar). Let’s face it, market corrections are never fun and they usually feel worse than we anticipate them feeling. We all know the key to a successful investment strategy is keeping a long-term perspective, but many times that is easier said than done. In times like these, it is a good idea to press pause and remember some fundamentals:

- Remember why we’ve invested in the first place – Investment portfolios should be invested on purpose and for a purpose. We’re working toward building and maintaining wealth for retirement, passing on a legacy, paying for college or other life objectives. Reacting to short-term market fluctuations may jeopardize those goals if we take ourselves out of the market.

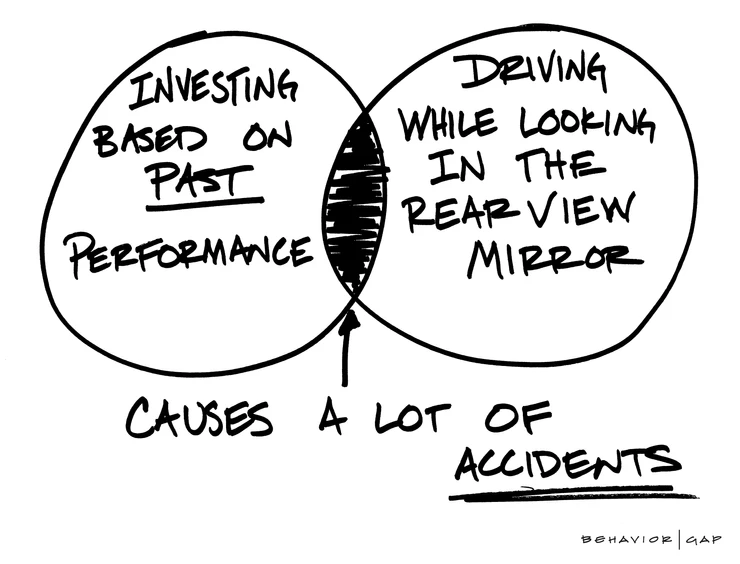

- It’s about time in the market, not timing it Trying to time every market correction is an approach that no one can consistently get right. You, someone you know or have heard of may guess correctly every once in a while, but will likely guess wrong several times in between, negating those returns.

- Can I stomach this kind of volatility? No investment strategy is worth it if you can’t stick to it over the long haul. This correction could be a good litmus test to see if you are positioned too aggressively compared to your risk tolerance. In rising markets like we’ve seen for the last several years, the tendency is to see risk tolerance rise along with it. Are you as tolerant as you thought?

- Communication is key No one has to walk through this investment journey alone. If you have concerns about the market or how you are positioned toward your goals, we want to talk with you about it. We are fully invested in making sure you reach your goals and are confident in your financial future. Always feel free to give us a call, shoot us an email or stop into the office. We’re here to help.